Lien Redemption Report

RSA 80:70 states, “When full redemption is made, the tax collector shall within 30 days after redemption notify the register of deeds of the act, giving the name of the person redeeming, the date when redemption was made, the date of the execution of the tax lien and a brief description of the real estate in question, together with the name of the person or persons against whom the tax was levied.”

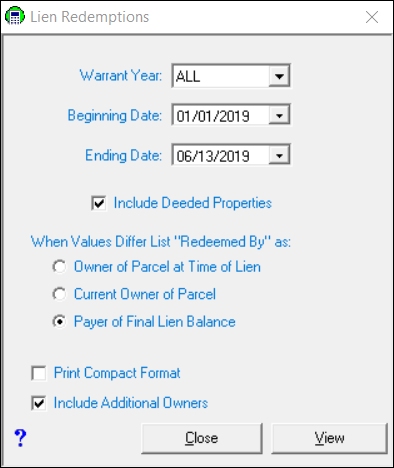

The Lien Redemptions Report is used to meet the requirements of RSA 80:70. It may be printed for a specific lien warrant, or for all lien warrants, by date range. To run the Lien Redemptions Report choose Reports | Lien Redemptions. The Lien Redemptions dialog box displays.

Fill in the information as follows:

- Warrant Year: Using the Warrant Year drop down box, select the lien warrant to restrict the report or leave as ALL.

- Beginning Date: Usually, this is the day after the ending date from last time the report was run. Example: If, in February, you ran the report 01/01/20xx to 01/31/20xx, in March, your beginning date would be 02/01/20xx.

- Ending Date: This is the date the system should include records posted up to. It is advised that you allow sufficient time for checks to clear the bank before releasing a lien. Many Collectors use a two week period, so using the example above, you would not run the report for the month of February until March 14th and the ending date would be 02/29/20xx.

- Include Deeded Properties: This check box is used to release the liens on the properties that were deeded to the Town through the tax deeding process. Click in the check box to select this option.

There are three options to choose from under the section "When Values Differ List “Redeemed By” as"; Owner of Parcel at Time of Lien, Current Owner of Parcel, Payer of Final Lien Balance. Note, the Payer of Final Lien Balance will display the Payer you entered when making the final payment for that lien. For example, a property is owned by Smith, John and Citizens Bank sent a check to pay off the lien. If you enter Citizens Bank as the Payer at the time of the payment, Citizens Bank will display as the Redeemed By on the Redemption Report. If you leave the payer as Smith, John, he will display as the Redeemed By. Select the radio button next to the option you wish to use.

The "Print Compact Format" check box, when checked, will include the town header on only the first page and the signature line on just the last page of the report. This option allows you to reduce the number of pages and paper used in printing the report. We encourage you to check with your county registry prior to sending a Lien Redemption Report in a compacted format as some county registries require a town heading and signature on each page.

The "Include Additional Owners" check box lists all owners of record to the property on the Lien Redemption Report. If you included additional owners when you executed your lien (which we strongly recommend), you must select the “Include Additional Owners” check box in order to release the liens that were recorded in their names.

The blue question mark icon located in the bottom left of the dialog box is to assist you with the topic at hand. Clicking on the blue question mark will bring you to the corresponding help topic within our online documentation.

Once you are sure everything is correct, select View. The report will display. Verify the information and print the report (see Printing). Make a copy of the report for your records.